Why Workday is a Major Threat to SAP

Category: Workday HCM Posted:Jun 26, 2018 By: Robert

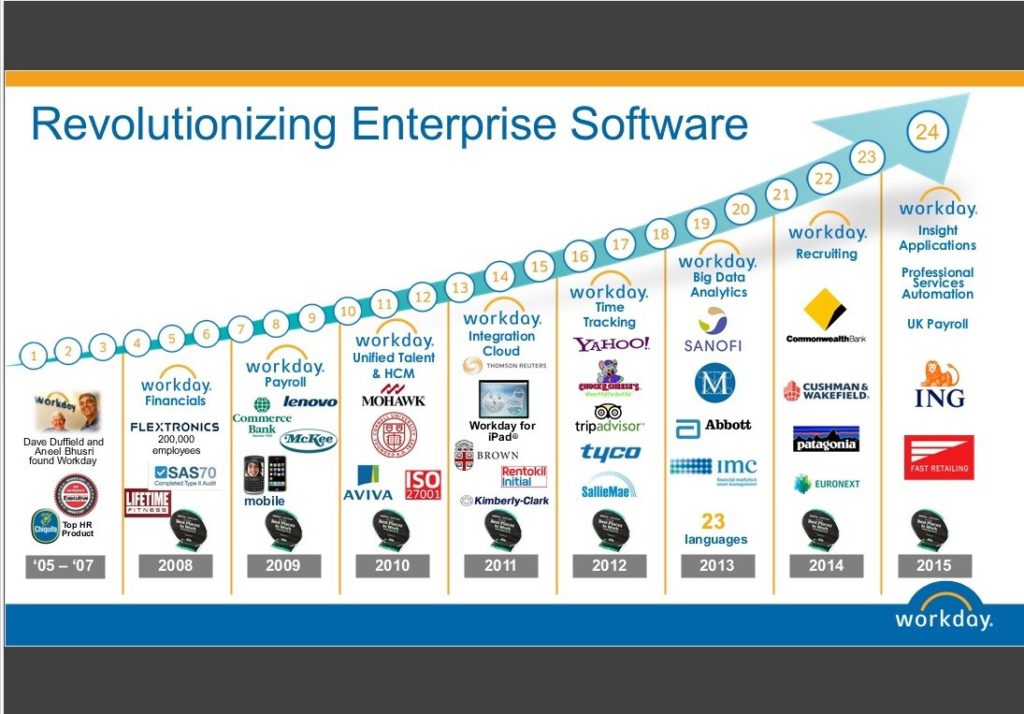

Oracle and Salesforce are two of SAP’s main opponents off-late. But Workday is of specific significance to SAP as they generate similar products for the IT domain. The Workday is an enterprise that was founded in the year 2005 by David Duffield who was the former CEO of PeopleSoft along with Anil Bhusri who was the chief strategist at PeopleSoft. Workday had launched it’s Human Capital Management (HCM) solution in the year 2006 in November and has consistently added spend management and finances. They also have a robust partnership with Salesforce and other Enterprises to help augment their product offerings. The Workday started off as a private organization that has its headquarters in Pleasanton, California, and currently has around 8200 employees. Workday focuses on ERP software and aims at large and mid-sized Multinational Enterprises, which are key players in the market for SAP.

Given below are the prime reasons as to why Workday poses a threat to SAP:

1. In-Core Memory

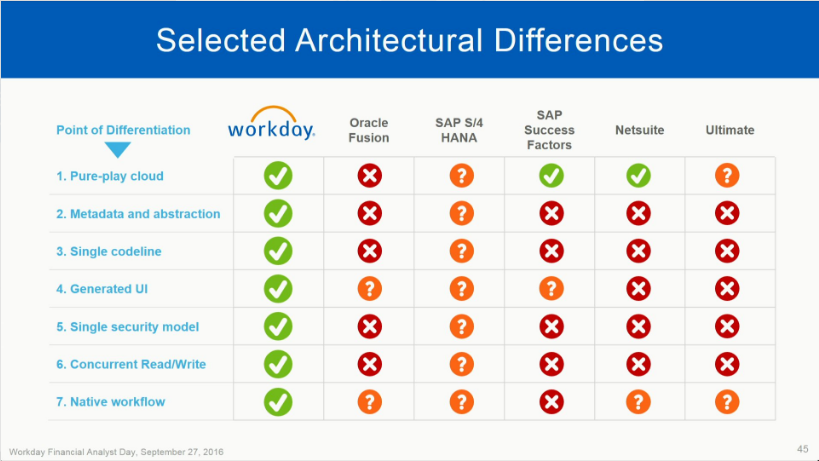

The Workday was the first word in “in-memory” database technology and has incorporated it into its software design from the very first, making its ERP is cutting edge right from the get-go. When compared with SAP – SAP adoption of in-memory technology is quite recent and requires further work when compared to Workday’s already established in-memory tech. The major difference between SAP and Workday is the in-core memory resident database usage. The SAP is presenting in-memory technology as the game-changer in the current market scenario for enterprise software. But Workday has been using it for several years before SAP ever thought of integrating it into its products. This means that SAP will have a major challenge on its end to differentiate itself from its close competitor Workday.

2. Product

Like any great product, the Workday Software Solution suite has been created from the ground up over a period of 6 years, making use of a multi-tenant Software-as-a-Service (SaaS) platform. This has an underlying service-oriented design. Since this product has been built from scratch, they have trust in the design which is modern, coupled with robust analytics, usability, functionality, and mobile applications which are the technology of today and the foundation of tech for tomorrow. Such a range is essential for current-day enterprise customers. Workday’s technology strategy goes hand in hand with its advanced design provided by their Chief Technology officer Stan Swete. Workday has an edge over the SAP Business Suite, which has an older architecture and less updated user experience. It is vital to remember that Business ByDesign and on-demand products are also adopting multi-tenant SaaS model even though neither of them has the range of functionality that is required currently.

Checkout the Article-What is the Role of Workday HCM in Simplifying HR Functions?

3. Innovation

“Workday updates” are offered by Workday three times a year using the multi-tenant SaaS model. So the complete Migration of the customers to the new version takes 6 weeks, which is a small amount of time. This means that all the customers can be on the same page with the latest release that hits the market. Every customer will have a sandbox duplicate of their production data which they can utilize to preview the respective Workday update. Using the preview, customers can decide what new functionality they would need to enhance their operations. The pace of innovation at Workday is incredibly fast with Workday being able to deliver updates that are cutting edge and are exactly according to customer needs. A great example of this is a new functionality based on iPad applications.

4. Management Team

Anil Bhusri and David Duffield had really significant roles in developing PeopleSoft into a success. Both of them have developed a high-end management team with an ERP industry background who are well versed with SAP and their product strategy. The management team of Workday is also familiar with the difficulties that customers face with on-premise solutions and have earned the respect of software analysts throughout the world – which is a usually hard thing to do. This means that the management team in Workday is excellent, to say the least, which provides Workday with a huge advantage over SAP. In the case of SAP, there is strong leadership too, but the size of the company works against them with its presenting challenges of prioritizing various issues within the company.

5. Wall Street

Going to the founding of Workday was done by David Duffield who was a billionaire and is considered as Silicon Valley’s most experienced and respected startup CEO. He has raised over 160 million dollars in private capital from Greylock Partners and New Enterprise Associates. Because Workday started as a private company they have been able to make smart investments in the software and build their company from the ground up without giving in to the pressures of Wall Street. The fact that Salesforce is Workday’s customer is also a huge factor in gaining on SAP. Coming to SAP, it is a publicly-traded company (well before Workday went public in 2012), which is massive and faces the challenge of tackling maintenance review of their on-premise products. They also simultaneously face the challenge of selling their new SaaS products such as Business ByDesign and on-demand.

Even though Workday has a smaller number of clients it has major players such as Flextronics, Kimberly-Clark, Chiquita, Time Warner, Thomson Reuters, and the list keeps growing. Customers of enterprise software usually go to companies that bag the big deals or consumers. Also, Workday has built up a loyal consumer base and has a strong product with an excellent management team. It is providing innovation at an accelerated pace when compared to anyone else in the enterprise software arena.

The Relevance of the Cloud

A threat from new SaaS solutions, especially fast-growing Workday, has market leaders SAP and Oracle pours resources into developing their own Cloud presence.

Cloud is taking a prime operational space in the market. This is the space that was dominated by on-premise systems. Most Enterprises were reluctant to let software-as-a-service applications, manage sensitive data, but with current day technological resources, this is fast changing with most Enterprises looking to the Cloud for higher efficiency and market dominance.

Most businesses find the main argument against going for Cloud-based HR management software is getting stuck with data migration and management issues. Large Enterprises have invested millions of dollars over the years in conventional ERP systems, mostly Oracle and SAP which have embedded HR processes and Systems. The main issue here is that Enterprises can’t switch to a new product, two or three years after the implementation even when a new approach is viable. Retaining the Legacy ERP and tagging along a different HR tool may also be equally troublesome as integration will not go well.

But such trends have changed dramatically over time. A survey by Towers Watson Company with a target audience of 628 Enterprises has revealed a lot of insights. It has shown that 24% of these Companies actually implemented a new Human Capital Management System in the past 18 months. Within American companies, 22% of the Enterprises as of now implementing a brand new primary HR tool are in the process of doing so.

Survey Company Towers Watson refers to the HR system as a primary system, but customers refer to it as core systems. A core HR system usually refers to one that manages employee personal data, payroll, benefits and taxes. Along with these functionalities, there are new vendors coming into the market which sell talent management tools for the remaining HR related processes. This includes succession planning, performance management, recruiting, career development, on-boarding and compensation management.

It can be noted that Workday opponents such as SAP and Oracle and other vendors who focused on on-premise solutions have also added talent management functionalities to their existing on-premise products. Such talent management products have been developed in the Cloud. On-premise products still have a strong foothold in the current market scenario, especially with regard to the HCMS market. But current trends have urged the conventional vendors to increase efforts in the creation and enhancement of their proprietary HCMS products in the Cloud.

One of the major differences between SAP and Workday was that SAP had to acquire SuccessFactors while Workday had built its products from scratch. Now, SAP has focused all its efforts on the integration of SuccessFactors products into its existing technological advancements. This means combining on-premise and Cloud solutions to obtain a hybrid talent management solution. SuccessFactors has a fully featured core HR system named – Employee Central which helps it deliver turnkey HCMS capabilities in the Cloud. It is significant to know that the future of the HR market lies in the Cloud or at least will transition using the Cloud into other future elements.

Thomas Otter is the lead HR technology analyst at Gartner, the Global enterprise for predicting and analyzing market trends. Otter says that on-premise solutions are an ongoing effort for most enterprises in the current market scenario and they can’t quit such on-premise solutions “Cold Turkey” (all at once). And if Enterprises were to start from scratch in the current market, they would without a doubt go for the newest technology which is Software-as-a-Service applications.

Checkout the Article-What Users Should Know About the Workday Calculated Fields

A Growing Threat

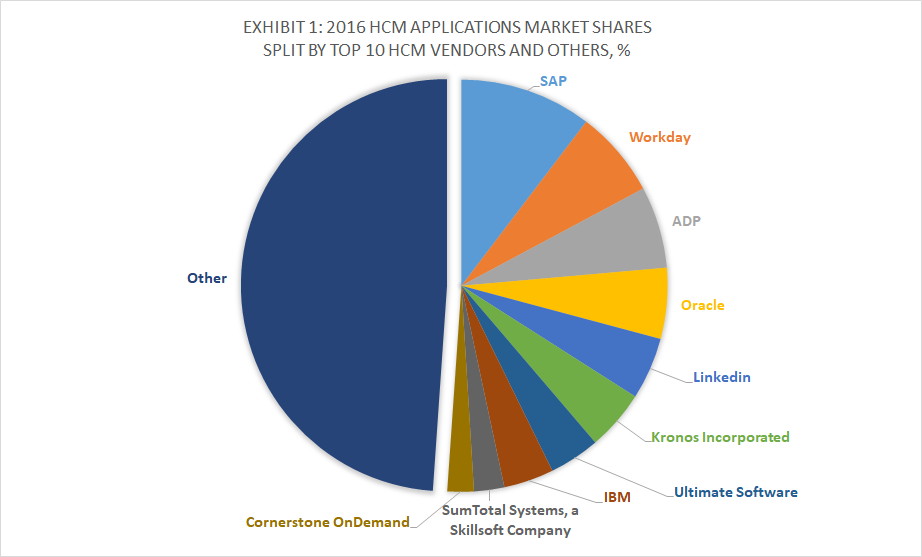

They’re also independent vendors of Cloud-based talent management tools which include Cornerstone, on-demand, Ultimate software, and Kenexa. All these are providing different combinations of the product similar to what SAP and Oracle provide, which adds to the threat that Workday poses to SAP. In some instances, such as smaller players have specialized in their products to be known as the best of the best in the niche products that they provide. A great example of this is Taleo’s recruiting application.

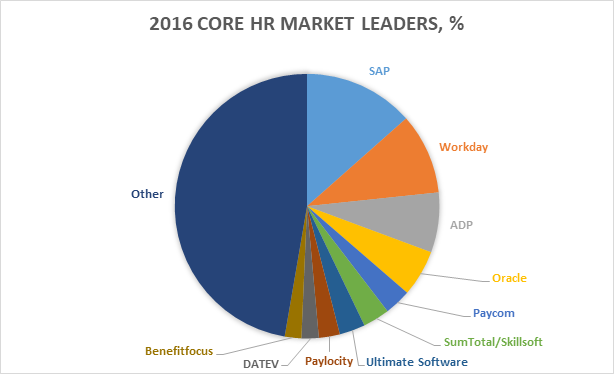

By far, the biggest concern for Oracle and SAP is Workday. This is because Workday does not fit into any HCMS category and as market analysts, but it was the main reason why SAP acquired SuccessFactors and Oracle acquired Taleo.

Gartner lead Technologist Otter says that Workday is gunning to be a holistic ERP presence in the Cloud. By far, Workdays primary market focus has been on HCMS, where it has a strong line of talent management and Core applications. Workday has also skillfully expanded into a broad range of applications for every existing financial function, which includes core finance such as accounts receivable, accounts payable and general ledger. Also included is procurement, expense management, governance and compliance management, reporting and analysis and cash management.

Another Cloud player that is comparable to Workday is Netsuite, which focuses on a broad range of financial and HR associated tools. Netsuite aimed its products at medium-sized Enterprises, although it is prepared to take on larger Enterprises as its customers also. In the context of Workday, their focus is only on companies with an employee headcount of 1000 or more.

The Otter has also said that Workday is the very first vendor that can truly rival the Oracle and SAP duopoly in the large enterprise market. As of now, it has proven with certainty that it can be a top market contender in the domain of HCMS. Workday products have maintained consistency and similarity between PeopleSoft products which belonged to Oracle. This means that the customers of PeopleSoft find it easier to adopt Workday.

The Workday is gaining popularity at a much faster rate than SAP and as of 2012, it had raised an amazing 250 million dollars in venture funding on a valuation of 2 billion dollars. As of then, it had 310 + customers medium and large Enterprises with revenue growth rates at more than hundred percent per annum.

Market Jockeying

In 2011, SAP had 18% of the complete HCMS revenue in the market, including maintenance subscriptions and licenses and Oracle had 17%.

Towers Watson in 2011 produced a report in which 18% of Enterprises had implemented a brand new HCMS or were planning to do so soon and such companies had selected Workday.

Market analysts have characterized Workday as an ERP that is still under construction. But the Vice President of product strategy at Workday says that its product is more than just ERP: and is a solution that is highly adaptable and configurable and based on the Cloud. What this comment actually means is that Workdays products can’t be boxed into an ERP solution category. This would limit its scope and would not do justice to the description of the product. Workday says that it can solve problems for Enterprises, which crop up due to architectural decisions that were made before considering changes in the future markets. In this context, change includes regulatory changes, technological changes, and other associated changes in a volatile and quickly changing market landscape.

Cloud Appeal

The HCMS market is not limited to SAP, Oracle, and Workday and extends well beyond them. But the Workday software as a service company is growing as a threat to longtime market leaders SAP with Cloud Technologies gain Momentum with each passing day.

The present cutting-edge Cloud-based systems are generally easier and more similar to deploy than using an on-premise system. The Towers Watson survey has shown that the user interface of Workday was its unique selling proposition for customers with 58% of the survey group rating the user interface as the chief reason for buying the product. Customers have said that Workday’s product is easier for HR to use and for employees and manages to use as well. The next feature that popularized the Workday product is a lower maintenance cost for it supports hardware and overall system maintenance compared with other on-premise solutions. This will mean moving to the Cloud for most enterprises bringing higher efficiency and operational success. Lesser hardware and employees will be needed, but this will be partially overcome by paying subscription fees on an annual or monthly basis as a post for a one-time fee for the software. While the cost of moving to the Cloud is similar to a fixed cost, it can be brought down and will be lower and for most companies, maintenance cost is a major factor that affects the enterprise revenue. For large Enterprises that have significant funds for improving operations efficiency, the adoption of Cloud-based products will bring in at least a 125% increase in the effectiveness to achieve business objectives. Research companies invest most of the time in analyzing data and validating the same with clients to ensure their expectations are met.

This is the main reason why Oracle and SAP are concerned about industry consolidation as being threats to their growth as an enterprise. Everyday Enterprises get calls for a specialized vendor from consumers looking for usability, speed, responsiveness, and holistic innovation. Workday has been delivering three or more major product updates every year and there is no way that a non-premise provider could match that.

The window of opportunity for Cloud-based systems is expanding. With every passing day, corporate executives are deciding on leaving organizations that are stuck with on-premise tools without an option to expand. With employees themselves decide the course that an enterprise should take, it is coming as no surprise that organizations are changing their business strategy. The change is to align Cloud-based Technologies to close capability gaps that may make the company vulnerable to competition.

Conclusion

Enterprises are starting to adopt Cloud-Based Technologies for Human Capital Management to a much higher extent than they have before, as the perception of HR has changed. Human resources are a vital enterprise operation and some of them are mission-critical such as payroll, but talent management applications can afford to take on a bit of downtime without the business getting hit. Even in the absence of talent management applications and companies can still work orders and ship any product available in their inventory. This means that it has a lot of scopes to improve. Workday being the juggernaut corporate presence that it is, SAP stands to lose a lot of it doesn’t match Workday’s product quality and innovation.

These are the related articles that you can check

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999