Fiscal Year Variants in SAP S/4HANA Asset Accounting

Category: SAP S/4HANA Posted:Jun 25, 2020 By: Robert

Several companies operate in multiple areas and countries. Consequently, they need to report on their fixed assets based on various legal and valuation frameworks. SAP S/4HANA offers the tools and processes to fulfil these parallel valuation requirements. Still, several requirements could be technically challenging to meet, such as when different fiscal year variations require to be utilized in the different valuation frameworks.

The Fiscal Year Variant (FY variation) figures out the financial durations and their calendar assignments, which are utilized to post documents in financial accounting. As an example, among the frequently utilized standard SAP fiscal year variants is K4, which matches the calendar periods: period 01 represents January, period 02 to February, period 03 to March, and more. However, in some countries or industries, it prevails to utilize more specific fiscal year variants, such as the 4-4-5 fiscal year variant. It is often utilized in industries such as retail as well as manufacturing. In this fiscal year variant, each quarter consists of three periods, consisting of 4 weeks, 4 weeks, as well as 5 weeks. Such a fiscal year variant has a wider start and end date than the calendar fiscal year variant, which presents a technical challenge to asset accounting in SAP S/4HANA.

Let’s take for example a company that uses the 4-4-5 fiscal year calendar for US GAAP group reporting, and the standard calendar year (K4) for local GAAP reporting in the different countries in which it operates.

In S/4HANA is possible to assign various fiscal year variations to the different ledgers in General Ledger accounting. It is likewise possible to have various fiscal year variants in the different asset depreciation areas, which are assigned to those ledgers. Nonetheless, there is a technical limitation that these different fiscal year variants require to have the same start and end date, only the durations could be different. This is explained in the OSS note 2220152 – Ledger approach as well as Asset Accounting (new): Alternative fiscal year variant for parallel valuation.

Since both fiscal year variants in our example have different start and end dates than the variant used for local reporting, it is not feasible to assign them to different depreciation areas within the same graph of Depreciation. If you do that, you will obtain an error message when trying to assign company codes to the chart of depreciation, which is configured in this manner.

Additional Representative Ledger Solution

The recommended solution is to use an additional representative ledgers. It includes creating additional ledgers that have the FY variant used in the leading ledger and serve as a representative ledger in the new ledger group.

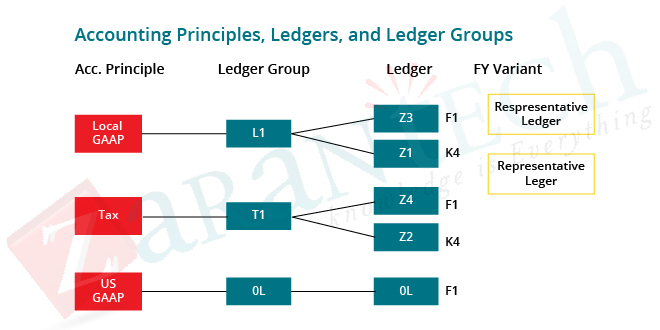

In our example, we will utilize the leading ledger 0L to stand for US GAAP valuation, and two more accounting principles, which stand for local GAAP and local tax valuation. The 0L leading ledger will use the 4-4-5 FY version, which we will call F1. We will create ledger Z1 as well as Z2, which will certainly stand for local GAAP and local tax valuation and will utilize FY variant K4. Then we will also create ledger Z3 and Z4, which will be assigned to the same ledger groups along with Z1 as well as Z2, but will use the F1 variant, and will be noted as representative ledgers.

Schematically, this looks as complies with:

Using this method there will be no technical mistake when assigning company codes to charts of devaluation. The ledgers Z1 and Z2 stand for the valuation according to local GAAP as well as Local Tax, using the K4 FY variant. Nonetheless, there is still a technical constraint that in Asset Explorer and in various other asset reports will be presented values and periods based on the leading ledger FY variant only. This is standard SAP actions, as explained in the OSS note 2490222 – Additional Description to SAP Note 2220152: Alternative Fiscal Year Variant/ Parallel Valuation/ Period Determination/Reporting. As the note discusses:

- The asset values including depreciation are not shown in the Asset Explorer (transaction AW01N) from the alternate fiscal year variant of the non-representative ledger for a parallel valuation (and according to the accounting principle assigned in the pertinent depreciation area).

- Instead, it is the fiscal year variant (FYV) of the representative Ledger of the parallel valuation that is represented in the planned depreciation periods as seen in the Asset Explorer. This is correct yet often thought to be a mistake or a system error.

- An expectation and assumption are that the depreciation area assigned to a parallel accounting principle and with a non-fiscal year variant need to be shown with the posting periods of the alternative FYV: this is not the case in the Asset Explorer and also in FI-AA Reporting.

This suggests that the amounts and the periods displayed in asset reports are based on the F1 calendar, also for the Local and Local Tax depreciation areas.

The reporting for the non-leading areas ought to be done from the non-leading ledgers, which use the K4 variant (Z1 and Z2), from table ACDOCA (General Ledger line item table). This is feasible with conventional SAP reports, or with customer developed reports from the ACDOCA table, if there are extra complex requirements.

Standard SAP reporting can be utilized via the following menu path in SAP Easy Access:

Accounting – Financial Accounting – General Ledger – Information System – General Ledger Reports – Financial Statement / Cash Flow – General – Actual/Actual Comparisons – Financial Statement: Ledger Comparison.

Alternative Solutions

It is also possible to implement alternative solutions:

- Change the leading ledger fiscal year variant, if it is feasible to adopt a variant which has the same start and end date as the one used for local reporting there would be no technical concern.

- Implement an extremely complicated solution to create additional company codes with the local FY variant, and develop a program to replicate all fixed asset postings to these company codes, which will be used for reporting. There was an additional paid tool from SAP called Asset Accounting Multiple Calendar Tool, available in previous SAP releases, which automates as high as feasible the posts to these “mirror” company codes, however, it is not available with S/4HANA. Still, it is possible to develop a similar custom solution, however, it would be a significant advancement initiative.

Final Thoughts

The most effective method is the additional ledger approach, which is the most cost-effective. Depreciation amounts monthly comply with the leading ledger calendar in Asset Accounting, nonetheless, on a yearly basis, it stands for properly all valuations, and no ledger level also the proper periods can be reported.

If you are planning to boost your skills, choose our best online training platform, and learn from industry experts. So what are you waiting for? Visit Zarantech, to skyrocket your career with the unique learning needs because Learning Never Exhausts The Mind.

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999