You Should Know About SAP Central Finance

Category: SAP S/4HANA Central Finance Posted:Jul 10, 2020 By: Ashley MorrisonSAP Central Finance

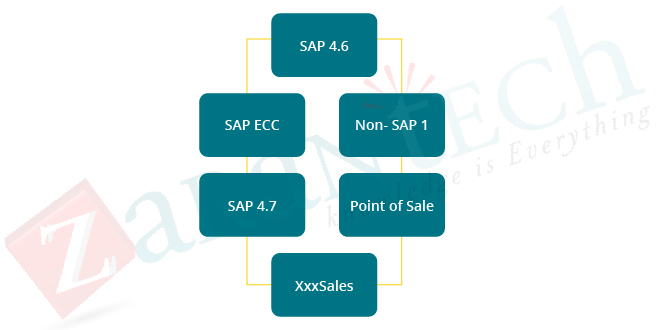

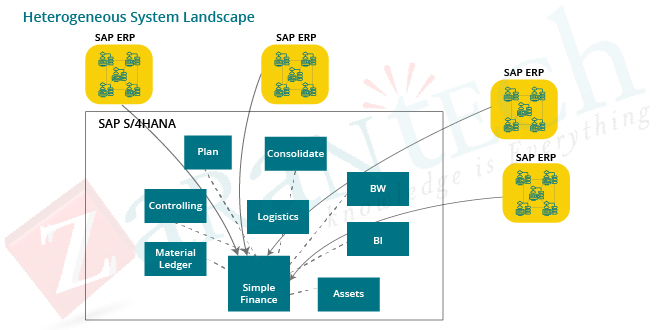

With Central Finance, customers can connect their distributed system landscape, to a central SAP S/4HANA Finance system. This can be made up of a combination of SAP systems of different releases and non-SAP systems. Financial Accounting (FI) as well as Management Accounting (CO) postings can be replicated into this Central Finance system.

Central Finance enables you to create a common reporting framework. To prepare for this common framework, you have to map your different accounting entities (as an example, account, profit center, or cost center) in your source systems to one common set of master data in the Central Finance system.

You can then replicate financial accounting and management accounting postings.

Financial accounting, as well as management accounting posts, are replicated to the Central Finance system. There, FI documents and CO postings are integrated into one documents, the universal journal entry. Furthermore, all-cost elements belong to the chart of accounts.

Before you replicate CO postings to the Central Finance system, you need to ensure that accounts are available for all cost components.

Click here to Know More About SAP Central Finance

SAP Central Finance Scenarios

How does Central Finance Work?

The functional foundation of a central finance system is driven by the features and also functions available in the underlying central SAP S/4HANA system.

This system includes components that are currently part of SAP S/4HANA (planning, shared services, reporting, consolidation, and so on) which were previously not part of the core SAP ERP system or were different products or applications integrated with the core system.

Advantages of Central Finance

We should know why we should know central finance as migration option:

A business transaction is posted in the organization every time and numerous copies of this transaction are migrated and saved all over the place; this is how the traditional system operates.

Traditional Legacy System Environment with Complexity:

Central Finance with Simplicity:

Central Financing represents a new method of financing is based upon a new set of innovations in an ERP system. Central Finance is a more conveniently deployable central system for Finance, enabling consolidated transactions, business planning, as well as group consolidation, and reporting and also analytics-all out of a single system without the need for further information replication.

Central Finance Cases:

- For Corporate Consolidation and Reporting

- To Centralise Processes across the organization

- As a Migration Path to S/4 HANA

- During Reorganisation and/or Mergers

Bottom line

Central Finance enables you to create a common reporting framework. To prepare for this common framework, you have to map your different accounting entities (as an example, account, profit center, or cost center) in your source systems to one common set of master data in the Central Finance system. You can then replicate financial accounting and management accounting postings.

If you are planning to boost your skills, choose our best online training platform, and learn from industry experts. So what are you waiting for? Visit ZaranTech, to skyrocket your career with the unique learning needs because Learning Never Exhausts The Mind.

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999