Step by Step Approach: SAP S/4 HANA Finance- Data Migration and Post Migration Activities

Category: SAP S/4HANA Finance Posted:Apr 13, 2020 By: Alvera Anto

This blog post gives an overview of Universal Journal, activities associated with migration and post-migration while converting SAP ECC systems to SAP S/4.

Data Migration in SAP S/4HANA via Migration Cockpit – In a new implementation of the S/4HANA system, data is moved from the SAP system/Non-SAP system to the HANA system. S/4HANA provides a comprehensive migration solution without programs needed by the client, automated mapping of data in between resource and target system, predefined templates, easily integrated custom-made objects, reduce test effort as well as minimize downtime.

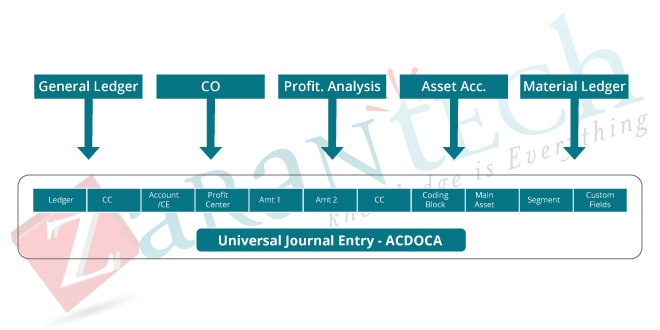

Universal Journal Entry

The Universal Journal Entry integrates the documents from Finance Accounting (FI) and Controlling (CO) and stores them in a single table ACDOCA. The Universal Journal Entry table becomes the single source of truth as well as eliminates the need for most of the reconciliation between FI and CO.

- Partitioning ACDOCA is important if the total number of records surpasses 2 billion. SAP’s best practice partition size recommendation is 300 to 500 million records.

- Secondary Cost Elements are migrated as Secondary Cost GL accounts.

- Merging the Cost Elements and also GL accounts require manual modifications to authorization as this isn’t done automatically throughout the migration.

- “Analyze Transactional Data” checks all documents are complete and appropriate. Any kind of inconsistency should be cleaned up before migration. If the inconsistency isn’t relevant anymore, it can be neglected.

- “Reconcile Transactional Data” checks the following:

- Zero balance compliance.

- All line things have header data.

- Documents have the same amount in BSEG as well as the new GL table FAGLFLEXA.

- New GL additional index table FAGLBSIS, FAGLBSAS are checked Accounting Document for Additional Ledgers (BSEG_ADD).

- Database views for index tables return the same value as backup tables * _ BCK.

- CO documents have their corresponding header data.

- Data enrichment is done in between line item tables and header tables.

- ” Check of Migration Documents” examines all Documents that are enriched effectively.

- The data enrichment followed by checking the data should be done even, for the customer that doesn’t have transaction data.

Migrating to new structure / Filling the ACDOCA Table

The transactional data from the applications FI, FI-GL, FI-AA, CO, ML are joined as well as upgraded by the high qualities of account-based CO-PA (if used) in Universal Journal Entry and there is no change to BSEG.

FI and CO documents can have 1:1, 1: N, and N: M relationships. The migration of 1:1 and 1: N are somewhat straightforward. Migration of N: M can get completed depending upon the number of FI and CO documents.

Migration of Balances

- For FI balances, delta values from ledger total, line item of BSEG as well as line items of FAGLFLEXA are considered.

- Delta of the CO totals to the line items and the aggregated values of line items are considered for CO balance.

- Only the balances are migrated for material inventory totals.

- In case there is a difference between the sum of line items and balances carry forward, the “Migrate Balance Activity” posts the delta values at GL total level. This balance adjustment combined with line items migrated will certainly coordinate the original values.

If there should be any mistakes during migration, the following programs can be utilized to reset the movement to an earlier state.

- FINS_MIGRATION_UJ_RESET.

- FINS_MIGRATION_DLT_RESET.

- FlNS_MASS_DATA_RESET.

You may also like to read Why should the SAP customers be grateful to SAP S/4HANA?

The IMG activity”Check Migration of Accounting Documents to Universal Journal Entry” checks if all documents are migrated effectively. For instance, CDS views on FAGLFLEXA are checked against the FAGLFLEXA_BCK table.

The calculation of planned depreciation works as in the past. The new program FAA_DEPRECIATION_CALCULATE is utilized for recalculation. Please note that it is important to run this program before the initial depreciation run.

Post Processing

Once the migration is finished, the following activities need to be completed before releasing the system to regular production use. These tasks need to be possible after the migration is set to complete.

- CVI number range which was set to external during migration must be changed as the internal

- IMG activity” Transfer Application Indexes” is performed for Data Aging (cold storage of index data), for example, BSIS_BCK, BSAS_BCK, BSID_BCK, etc, This requires the business function DAAG_DATA_AGING.

- IMG activity “Fill Due Dates in FI documents” calculates the net due date and discount due date as well as stores them in BSEG, BSEG_ADD, VBSEGD, VBSEGK, and also VBSEGS tables.

- Offsetting Account Type, Offsetting Account Number, G/L Account of Offsetting Account is filled with the activity” Fill The Offsetting Account in FI Documents”.

Want to dive even deeper into the SAP S/4HANA topic? Click here Golden Rules for SAP Suite on HANA & S/4HANA Migrations

There are programs/transactions to keep track of all the migration and post-processing tasks. The logs must be checked altogether as the migration tasks won’t stop if there is an error. The error will be logged and migration continues. For this reason, it is essential to check the migration logs.

It is important to check the report snapshots when the migration by stakeholders to make certain the migration is completed effectively.

Conclusion

When you migrate to SAP Simple Finance Add On, it is fast and very easy. The duration is minimal, and you can execute at any type of period end.

That’s all for today. If you’re interested to read more articles on this topic, feel free to visit ZaranTech Blog. Enroll yourself in our SAP S/4 HANA Finance Training and Certification Course and take your career to a whole new level!

Happy learning!

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999