Top 5 Financial Processes Automated using RPA

Category: RPA Posted:Jul 03, 2018 By: Robert

Nowadays, Robotic process automation is one of the most leading services in the current economic system. The enterprises continuously want’s innovative techniques to automate their business processes in order to enhance their efficiency, to reduce cost and create new wellsprings of income. Due to this, a tremendous growth has been observed in the number and scope of the automated tasks.

In the year 2017, an investigation is conducted about the business and technology pioneers in more than 22 ventures and 40 nations by the Institute for Robotic process automation and Artificial Intelligence i.e. IRPA-AI. The data obtained from this study disclosed that the automation has become an integral part of relatively each process and industry throughout the world. Well, it is crucial to choose business processes to be the initial applicants for automation that are basic and repetitive. IRPA-AI mention rule-based processes which are standardized and with structured data and also labor intensive. The well-defined processes, utilized repetitive work and performing monotonous tasks in a huge volume such as back-office, data entry, and few help desk tasks can be selected as the processes for automation. The processes which are identified by IRPA-AI survey for automation are procurement, training and development, human resources, financial industry, core business operation and self-service operation.

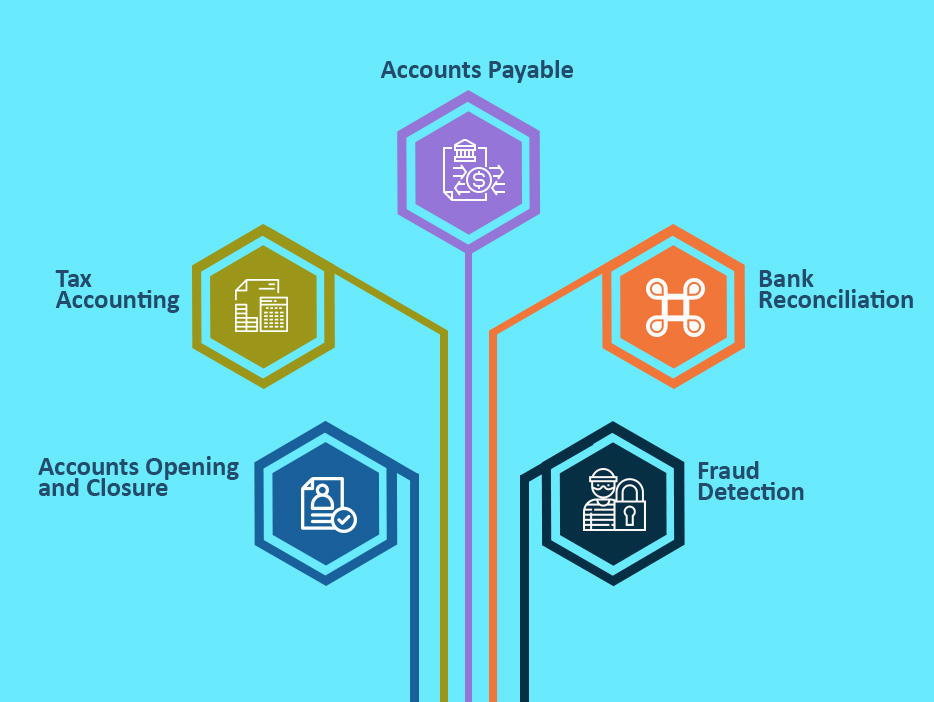

Presently, the biggest financial institutions are stepping ahead towards the robotic process automation. They are beginning the task automation with highly expressed model programs. The various repetitive financial operations such as accounting, data entry, invoicing can be easily automated using Robotics Process Automation. This is one of the most fundamental motives that financial processes were the frequently stated categories for the automation when it is asked that what processes are automated now and what processes the Enterprise is planning to automate in the future. With the help of the RPA, the companies can monitor the receipts, calculate taxes and pay invoices on time with nominal inputs from the workforce. Using this it gives us substantial savings and enhances productivity across the organization. Now, let us explore the different areas which can be automated using RPA.

Learn RPA Blue Prism from Industry Experts

1. Tax Accounting: In order to carry out the tax, accounting actions Global financial institutions spend millions of dollars every year. The tax calculation exercises are manual, repetitive starting from obtaining the essential information concerning the provisional balance, fixed assets, particular data of different companies to review tax returns and computing the delayed taxes. This information can work in combination with ERP platforms, financial management, and payroll processing software. The RPA enterprise can easily reach the quick outcomes in terms of tax automation while saving an intensive amount of offshore accounting. The current RPA tools are non-invasive which allows very little customization of the enterprise technology ecosystem. The RPA can be used to automate the tax accounting as it is the most general use case for automation.

2. Bank Settlement: A large amount of time and efforts gets spend by enterprises every year in reviewing and validating the inline transactions manually. Despite the fact that the various disjoint solutions have decreased the thorough process of going through journal entries, but there are still some challenges like transaction volumes, jumbled processes and the never-ending source of data feeds. A reconciliation that is settlement was considered to be the most primary use cases which is recognized by the experts in automation. This ensures the enterprise to make some fast, cost reductions while enhancing the workload of back-office staff, allowing them to involve in most satisfying activities. With the influence of RPA solutions, the enterprises can create applications for reconciliations. With the help of these applications the sophisticated data can be compared, journal entries are automated easily.

3. Payable Accounts: The RPA had shown its significant impact in accounts paying, as there has been always a situation of doubts that arise when there are variations and lack of structures in invoices. This is derived from the requirement on major RPA tools on Optical Character Recognition i.e. OCR technology, which were relatively ineffective in the initial phase of the previous era. But the OCR tools became so popular and gained maturity, with the features like automation, whose exception and approval would allow enterprises to reflect the process automation. With the utilization of the automation process, the state of doubt and uncertainty were balanced, which is one of the greatest advantages. Due to the automation, the error rate can also be reduced by a substantial edge which would spare cost and time. It also reorganizes systematic generation of an invoice which confirms the end to end processing of payment. Not only this, the capability to duplicate the RPA across other financial process and business segments make it easier to scale along with the increase of the business processes.

4. Finding of Fraud: The RPA technology has also shown its great impact in the field of fraud detection. As per a report by Javelin Strategy & Research, around 15.4 million customers were becoming sufferers of some form of fraud in the year 2016 approximating a total loss of about $16 billion. No matter in financial industry damages the enterprises more than the frauds and individuality burglaries. Nowadays, most of the organizations have developed some sort of mature system which is capable of handling the fraud detection proactively. With the influence of RPA techniques, the banks are now able to monitor and eliminates the risk of fraud before they end up massive to deal with. The automated alerts and notifications can be produced to included parties and can also be utilized to activate the events which confirm recovery. Additionally, the predictive analytics and machine learning platforms are used to examine the current data and the previous risks to generate security mechanism, so that the real fraud transactions can be identified and differentiated.

5. Opening and Closing of an Account: In today’s demanding and ever changing environment, the bank relationships managers have a very challenging job. They have to handle hundreds of accounts which are frequently assigned to them at the several stages of their relationship. This sets them against the challenges which are impossible in handling the several accounts at the same time while providing greater customer experience for each and every one of them. With the help of this, they are able to manage the failure as well. The automation has provided an immediate relief to the bank relationship managers. The example of this can be seen as India based Axis bank which has transformed about 85% of household and saving account opening, out of which around 50% of this is performed using eKYC.

Along with the RPA processes, customer onboarding for relationship managers are restructured, where they can monitor credit ratings and score easily, as well as can examine the default risks, and carry out the eKYC process using automation. In a similar manner, when it is required to close an account the robots can act according to the request generated by the branch and update the banking system, produces transaction id, input MIS with respect to the status. The RPA systems give exact output, which would help in decreasing the errors when it comes to postponed recovery charges or conclusion rate.

Nowadays, RPA techniques are utilized by other industries as well such as HR, Information technology, data analytics, procurement etc. to automate their business processes. Let us now explore the impact of RPA in these areas.

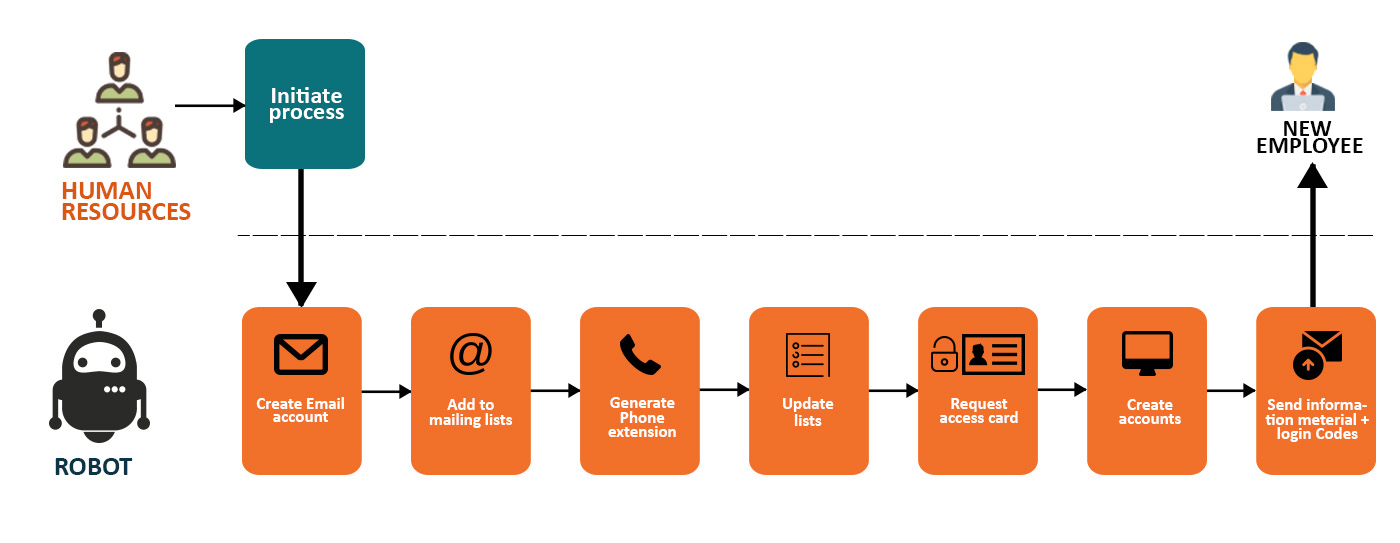

Human Resources: The HR department is responsible for keeping track of the huge amount of data of the employees across the entire company. With the utilization of new HR tools, the HR is able to monitor time sheets, store documents, calculate benefits, and provide onboarding information related to the workforce. These are the repetitive task for HR, which can be automated easily. Around fifteen percent of defendant reported that they have automated HR processes and around 13% of them are planning to automate the HR processes in the future.

Procurement: The processes like requisition approvals, invoice processing etc. can be significantly automated using RPA. The automation helps to restructure the procurement process and also decreases the dependency on extensive staffs while enhancing the service to business units. Due to this, the procurement becomes the third highest ranked process that companies are planning to automate.

Data and Analytics: The RPA technology is used in the automatic collection and data analysis. In every field, the automated tools are capable of collecting the information about proficiency, issues, and costs, which ensures companies to enhance the performances iteratively and keep track of the performances. Data and analytics are one of the basic application of RPA which is realized by most of the companies, which helps them for taking more effective decision directed by appropriate information.

Information Technology: The information technology is accountable for carrying and supporting automation for business elements, however, most of the processes in the IT can also be automated easily. With the help of RPA, it is possible to analyze and fix technical issues, the tickets can be tracked and even it offers technical customer service such as resetting of password and resolution of small problems. The other automation tools such as end-user automation tools can also automatically backup data, carry out system maintenance and also help the user if the errors arise.

These are few processes which can be automated easily using RPA.

Learn RPA UiPath from Industry Experts

Conclusion:

Thus, in order to save cost and time, the various business processes in the financial industry have been automated in last few years. Not only in the financial area, but RPA is used by other enterprises as well because the technological solutions are continuing to increase. The more prominent number of organizations are adopting these tools and most of the activities will be performed with the help of automation, as it is drastically reducing the dependency on the costly labor and also improves the service efficiency. The businesses which are continuing to invent and execute the automation across their enterprise will be going to capture a huge market share and will surely achieve the business goals in the upcoming years.

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999