SAP Treasury and Risk Management (FIN-FSCM-TRM)

Category: SAP FSCM Posted:Nov 19, 2019 By: Serena Josh

SAP Treasury and Risk Management depend on the progression of arrangements that fundamentally investigate and advance business forms in the money related region of an organization.

- Transaction Manager:

A central task in many account offices is closing monetary exchanges. Contingent upon the organization strategy, the accentuation can either be on giving inward support of the associated gathering organizations, or partaking effectively in the budgetary markets so as to contribute fluid resources, money arranged venture, or fence existing dangers. The Transaction Manager gives the instruments to preparing the related monetary exchanges, from bargain catch through to moving the important information to Financial Accounting. The framework underpins both conventional treasury divisions that emphasize exchanging just as resource the executive’s offices. This empowers you to utilize a similar stage for different kinds of exchanges – from transient accounts to longer-term key ventures.

The Transaction Manager causes you in the accompanying manners:

- It encourages you to deal with your budgetary exchanges and positions. This spreads exchanging and preparing of monetary exchanges, yet additionally installment and posting in Financial Accounting.

- It encourages you to use the current potential for legitimization and empowers you to robotize normal procedures.

- It gives adaptable detailing and assessment structures for dissecting your money related exchanges, positions, and portfolios.

- With the incorporation of Treasury and Risk Management, it empowers you to gauge straightforwardly the impacts of budgetary exchanges on liquidity or loan fee dangers.

The Transaction Manager can be utilized in organizations and resource the executive’s zones just as in customary Treasury divisions.

Features:

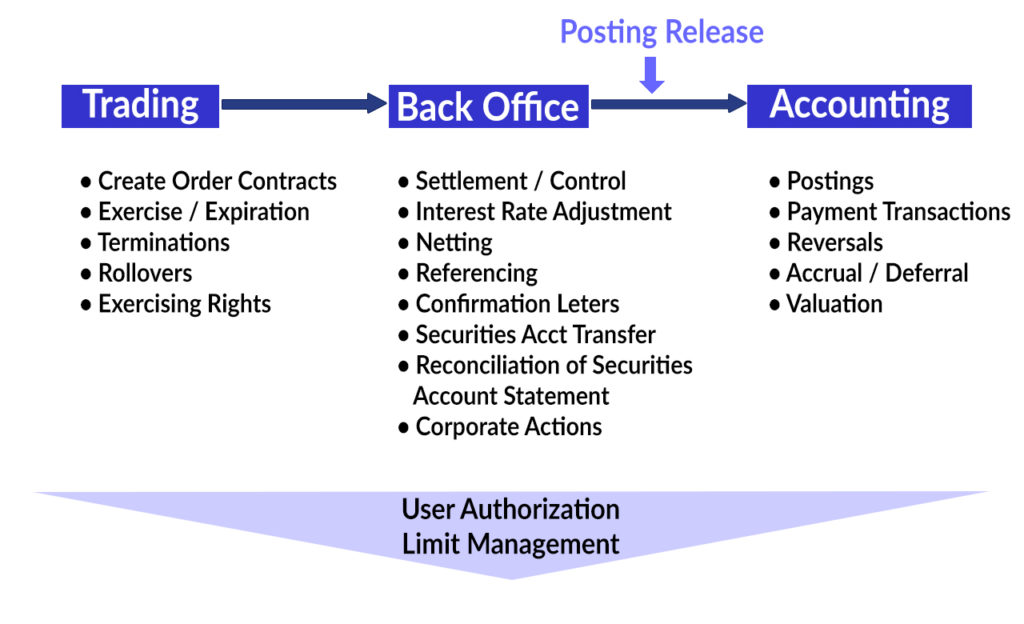

Straight-Through Processing :

The Transaction Manager sends the straight-through processing (STP) rule from the section of the distinctive exchange types through to their exchange to Accounting. For this reason, the front-end region has been ceaselessly upgraded, while capacities and fundamental structures have been institutionalized for monetary exchanges (money market, foreign exchange, derivatives, commodities, securities, and debt management) in the territories of correspondence, installment handling, bookkeeping, and valuation techniques. test

The Transaction and Position Management Process :

Overview:

You can arrange the exchange and position the board forms deftly for every item type. You do this utilizing justification. Simultaneously, you can build process security by executing authoritative necessities. The double control rule, for instance, is utilized as a significant safety effort for controlling discharges.

You can utilize various criteria to part and oversee places that you have in parallel valuation regions just as assess them utilizing diverse bookkeeping standards.

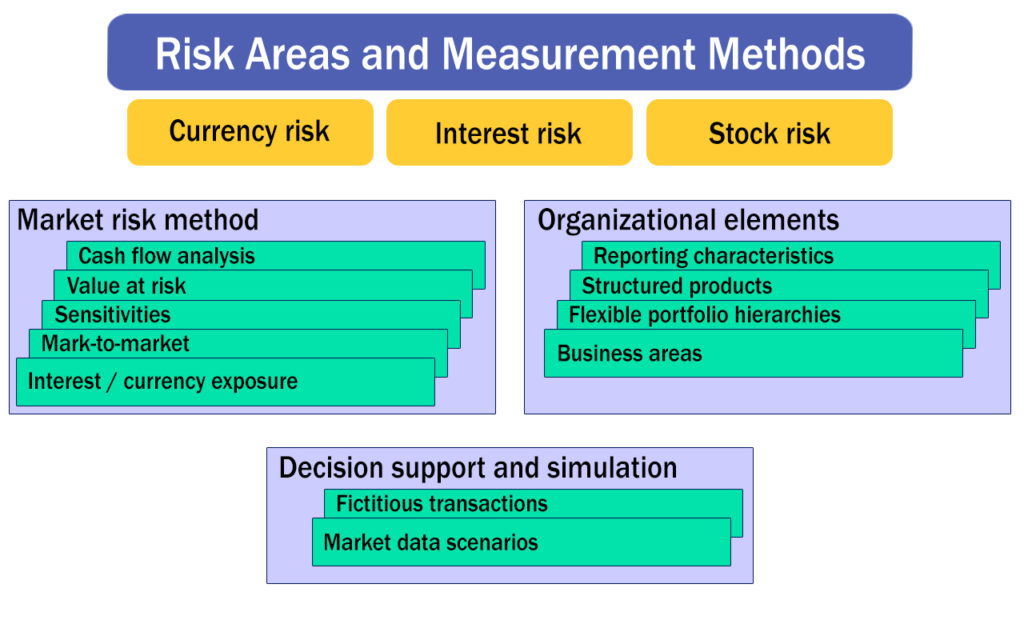

2. Market Risk Analyzer:

Other than customary money the executive’s assignments, for example, Cash management and liquidity assurance, viable showcase chance the executives is a conclusive factor in verifying your organization’s focused position. In this field, the Market Risk Analyzer offers broad position assessments, for example, mark-to-showcase valuations of money related exchanges. It additionally incorporates instruments for risk and returns figures, including introduction, future qualities, sensitivities, and value at risk. At the point when you run these reports, you can consolidate both contracted positions and imaginary monetary exchanges in the estimations. The valuations can be founded on both genuine and recreated showcase costs.

Together with a high level of adaptability for making reports, the Market Risk Analyzer gives a solid assessment premise to showcase chance controlling.

Purpose:

The Market Risk Analyzer (TRM-MR) part of SAP Treasury and Risk Management offers enterprises and insurance agencies a scope of capacities for overseeing dangers on a worldwide premise.

Of all the diverse outer dangers to which organizations working universally are uncovered, it is changed in advertising costs that are the most basic variables for organization achievement. They can profoundly affect the sum, present worth, or timing of installment streams. Employable business and Treasury exchanges the same are influenced by the market risk. So as to quantify and oversee hazards completely, it is basic to unite all hazard related organization exercises.

As of late, no other region has verged on growing such a broad toolset for measuring hazards as market risk management. Since it is nearly simple to get forward-thinking market information and authentic market information, it is conceivable to evaluate chance volume precisely. This information gives a perfect premise to risk management.

Market Risk Analyzer has been intended to cook for the prerequisites of all industry areas. It mirrors the prerequisites of the techniques utilized in the money related management area to gauge hazard and makes it conceivable to incorporate the installment streams from organizations’ business exercises in the chance examination.

Concept:

- Data collection

- Mark-to-market valuation and position analysis

- Sensitivity analyses and simulations

- Currency exposure

- Liquidity analysis

- Value at risk

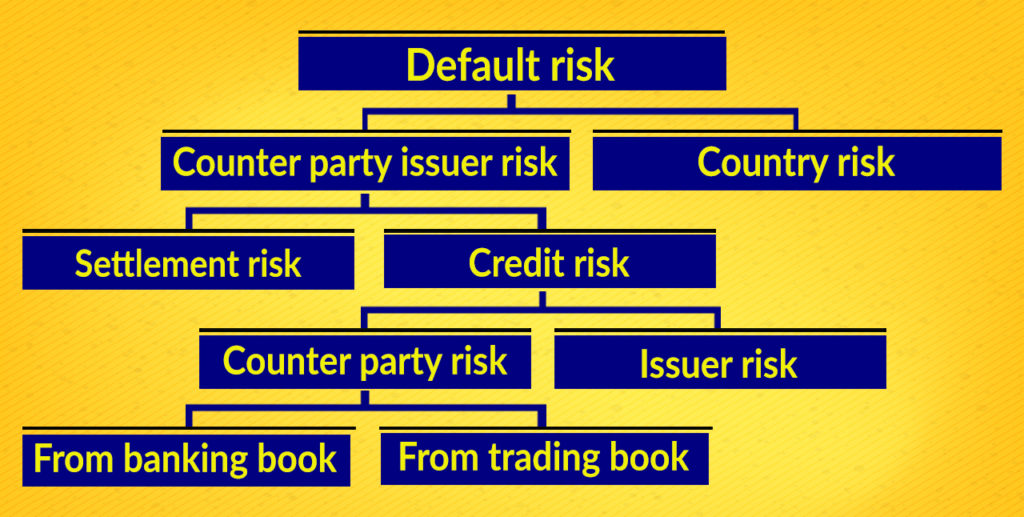

3. Credit Risk Analyzer:

The Credit Risk Analyzer centers around estimating, investigating, and controlling counterparty default risk. The primary stage intends to cover the particular risk related to money related exchanges in an organization. The Credit Risk Analyzer empowers you to control risk effectively by setting limits. This is upheld by adaptable utmost management capacities with web-based(online) checking, just as broad announcing alternatives. Thus, directors are in a situation to recognize acknowledge changes as they happen and make a hesitant move.

Purpose:

This TRM segment empowers you to gauge, examine, and control default risk. Default risk alludes to the potential misfortune emerging from a money related exchange should the colleague not satisfy his authoritative commitments either because of explicit, financial, or political reasons. Default risk is named pursues:

4. Portfolio Analyzer:

Given that the assets accessible for the investment are normally constrained, and that there are various alternatives choices to choose, the vital inquiry for investment policy choices is the way well the investment has really performed. The monetary achievement of an investment is, along these lines, a basic factor with regards to settling on investment policy choices. The Portfolio Analyzer is intended to give the appropriate responses with respect to the monetary accomplishment of investment. It quantifies the accurate profit for investment, thinks about the outcomes to recommended targets, and separates the general execution into its segment parts by ascribing the individual portfolio positions to the all-out outcome. The reason for these assessments is the portfolio structure, which gives you a chance to aggregate investment into various classes. You can run assessments for portfolios at various levels in the portfolio progression, or for an advantage class over a few portfolios.

Methods for Calculating the Rate of Return:

For the count of the rate of return, the Portfolio Analyzer offers techniques for ascertaining the time-weighted rate of return (TWRR) and cash weighted rate of return (MWRR). Notwithstanding the accurate techniques, the Portfolio Analyzer additionally offers the estimate strategies Dietz and adjusted Dietz for the count of TWRR.

Notwithstanding the rate-of-return key figures, you can likewise characterize the benchmark rate of return and think about them against the rate of return of your portfolio.

Integration:

Portfolio Analyzer is a piece of SAP Treasury and Risk Management (FIN-FSCM-TRM).

You can figure the rate of return for the accompanying exchanges:

- All situations in the Transaction Manager (FIN-FSCM-TRM-TM).

- Loans in SAP Loans Management (FS-CML).

- Nonexclusive exchanges (classes 0 and 9) in the data pool in SEM Banking.

I hope that by now you have had an overview of SAP FSCM. Before you enroll in ZaranTech’s certification course on SAP FSCM, do check out the tutorial for Beginners:

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999