Top Reasons to Implement SAP S/4HANA Simple Finance in Enterprises

Category: SAP S/4HANA Finance Posted:May 18, 2017 By: Ashley Morrison

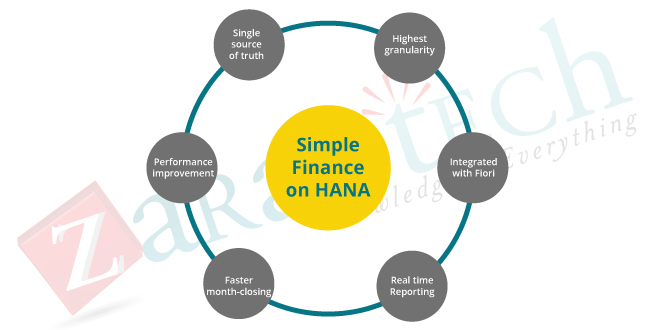

SAP ERP users have to be aware of the current product status considering the constantly evolving nature of SAP product offerings. When looking at R/3 and ECC systems, even though they still are operable, the world around these products is subject to constant changes. To get to the benefits offered by Simple Finance, we shall focus here on the key advantages of moving to SAP’s S/4HANA solution:

Simplicity

The modifications made to its ECC application structure have simplicity at their core. Eliminating most of the aggregate tables means that the ease and the processing time with which organizational systems can respond to transactions and queries are enhanced greatly. The time saved can be applied to greater strategic or organizational efforts and much lesser time needs to be expended on your application itself. Applications running natively on the HANA platform display the immense power inherent in HANA along with benefiting from much greater levels of democratized data access and contextual awareness.

Enhanced Ease of Use

Interfaces to ECC applications can now be run in an advanced web-based format via SAP’s innovative Fiori UI. Fiori offers what can be addressed as a modern design for a comprehensively redesigned user experience. SAP Fiori stands for a highly responsive, personalized, and most importantly simple user experience, irrespective of the deployment or device choices. This translates into end-users and organizations alike benefiting from role-based user experience across lines of business that are enterprise-wide.

Modernization

Most organizations today are pushing forth the idea of Modernization without users really comprehending what the concept means. One has to be clear on the fact that just because a product was released today, it won’t necessarily be modern, what a particular product can do for a user today that offers multiple future opportunities that’s what makes it modern.

SAP’s S/4HANA applications will offer users the very same ECC functionalities, but it will be in a manner in which will benefit from data accessibility, context, and speed that weren’t accessible before. In certain cases one may be compelled to upgrade their system at it may be on the cusp of losing support, or one may be needed to have particular aspects such as Unicode. In such cases, if a user is looking at options to move, then the best possible choice in this scenario is definitely S/4HANA.

One should also consider modernizing organizational data, before implementation of S/4HANA in order to enhance the prospective value of a large scale change such as this, and also to minimize the amount of time and effort one would instead expend on data quality post moving to the modernized system. Data modernization prior to moving over to S/4HANA should anyway be addressed right at the start since HANA need a lot lesser data and users will require to make few data choices before the S/4HANA move in the first place.

Preparing for future innovation

One of the most important advantages of S/4HANA is the inherent ability to gear up for future innovations in the development of SAP applications. It is an established fact that in today’s market scenario, technology in all spheres is advancing at speeds faster than most organizations can keep up with. If an organization or a system isn’t prepared well enough for a move or shift in technology then the enterprise will be stuck in a limbo-like state, trying constantly to catch up with their work, customers, and competitors. This is not a good situation to be in for anybody!

Aligning Cloud and On-Premise Application Scenarios

Users and organizations who are looking to commit to a Cloud-based future will find their needs met in the S/4HANA product which offers the capability to transition quite easily from the On-Premise version to the Cloud. And this is not just SAP-specific, with all organizations having to be ready for it, since an enterprise may decide on moving all applications, and possibly even its infrastructure to the cloud at any given time for mainly reducing cost-overheads. There is great news for businesses looking to gain from both On-Premise and Cloud scenarios through migration and coupled data quality solutions which can be implemented in either version or also applicable in a hybrid manner.

Checkout the Article-SAP HANA, S/4HANA, and S/4HANA Finance in a Nutshell

SAP S/4HANA Finance

Finance enterprises are faced with the immediate need to embrace the digital age to match the new and evolving business models and offer decision makers with instant insight. SAP S/4HANA Finance allows one to create a consolidated view of all operational and financial data to offer flexible and easy consumable reporting along with automation of processes. It also enables assessment of financial implications of business options along with real-time analytics, simulations and forecasting- all this is also augmented by an amazing user experience.

SAP S/4HANA Finance Innovations

SAP S/4HANA Finance is a holistic set of financial accounting and management solutions, spanning financial analysis and planning and enterprise risk and compliance management. It also stands for collaborative finance operations, treasury and financial risk management and even accounting and financial close.

This has been architected for the CFO’s of organizations whose solutions eliminate conventional boundaries between planning, analytical and transactional systems. This further aims to deliver instant insights with analysis that is executed on-the-fly across various levels of financial data.

Even though the complete financial management portfolio is covered by SAP S/4HANA Finance, there are considerably enhanced or new innovations accessible in each finance area. Given below are a few of the most important ones:

Financial Planning and Analysis (FP&A)

Using SAP S/4HANA Finance processes for Financial Planning and Analysis one can speed up planning cycles, boost profitability, and up the efficiency of finance functions.

Planners can access real-time master data along with accruals in SAP ERP without data replication issues. This is made possible by the optimization of the SAP Business Objects Planning and Consolidation (SAP BPC) version for SAP NetWeaver for SAP S/4HANA Finance.

A common financial planning model will enable users to run end-to-end simulations along with accelerated planning cycles. Given below are the summarized benefits of this feature of Simple Finance:

- Users will be able to embed end-to-end planning processes and utilize real-time operational data in order to remove the possibilities of redundancy and time-lags.

- Financial analysis can be run on-the-fly at desired levels of granularity utilizing an individual table in-memory

- Organizations can spend the whole financial planning lifecycle which involves updates, development, and even reporting

- Users can easily create simulations of an ad hoc nature relating to organizational changes or regarding new business models in the ERP system directly

Accounting and Financial Close

Enterprises will be able to enhance control and compliance, minimize closing workloads, costs, and even close the books faster using SAP S/4HANA Finance processes for accounting and financial close.

SAP Accounting integrates management and financial accounting along with profitability data into a single universal journal. And also eliminates indices, totals and other pre-defined aggregates and depends on line items as a singular source of truth.

The universal journal architecture comes integrated with Fixed Asset Accounting for SAP S/4HANA meaning redundancy of data is eliminated. Several parallel documents for every valuation are posted in real time to make sure values are correct right from the start. Given below are the summarized benefits of this feature of Simple Finance:

- Users will be able to execute closing tasks and inter-period processes in real-time

- One will be able to run real-time reporting with full drill-down according to any dimension

- Using a single, unified data model for simplification of processes is made possible with enhanced productivity, and minimization of risk

- Easy execution of depreciation runs along with simplification of the processing logic and data structures are also made a reality

- Users will be able to leverage line item postings for each individual asset, enabling detailed reporting

Treasury and Financial Risk Management

Using this functionality one can accurately predict cash flow, mitigate risk and manage liquidity. Integration of cash flows, commodity positions, market data and transactions is also made possible here, along with the optimization of straight-through processing including full-view and even real-time analysis, compliance reporting and audit trails.

Global cash positions in real-time are offered by SAP Cash Management, even when heterogeneous backend systems are present. Brand New Capabilities offer highly detailed analysis of predicted cash flows so that one can bring about higher levels of consistency to cash needs, cash balances, and liquidity strategies. Given below are the summarized benefits of this feature of Simple Finance:

- User can benefit greatly from integration of cash flow analyses

- Also possible would be integration of business planning, comprising of liquidity planning lifecycles

- One can also gain from a holistic central bank account management

- Real-time visibility of bank balances and currency exposures

- Enhanced executive engagement is enabled with an intuitive and modern user interface

Checkout the Article-Users Should Know About: SAP S/4HANA Sourcing & Procurement

Collaborative Finance Operations

Users can respond to fluctuating market dynamics at higher speeds than previously thought possible. Automation of receivables and payables processing, revolutionising shared services delivery, and streamlining travel management can all be done while minimizing costs.

Working capital and financial health are enhanced through SAP Receivables Management by utilizing real-time receivables data to evaluate customer credit risk, streamline billing, settle disputes and prioritize customer collections to minimize day sales outstanding. Given below are the summarized benefits of this feature of Simple Finance:

- Monitoring of customer payment behavior in real-time can be handled

- Proactive decisions can be made with exception-based receivables management

- One can find a customer’s top line contribution with an analysis that is highly simplified

- Enhanced reconciliation and analysis is possible with intuitive search functions and high degrees of usability

- Organizations can benefit from highly relevant and real-time data to transform customer interactions

Enterprise Risk and Compliance

Automation of compliance, international trade activities and risk can be done using this tool. The software enables optimization of business operations, enhances financial performance and even protects assets.

In addition, SAP Fraud Management provides insights needed to detect, investigate, and deter fraud. The software utilizes advanced and complex rules and algorithms on Big Data to recognize and forecast fraudulent behavior, generate alerts, and stop fraudulent transactions. Given below are the summarized benefits of this feature of Simple Finance:

- This tool enables the processing of high volumes of data to enable real-time fraud detection at the transaction level

- Centralization of fraud management is made possible in order to optimize investigation and monitoring

- Reduction of false alarms is achieved by calibration of detection strategies and executing real-time simulations

- Detection strategies can be modeled and simulations carried out to forecast fresh fraud patterns

- Harmonization of data can be executed to expose potential duplications or faulty, fraudulent entries

Conclusion

I hope that by now you have had an overview of SAP S/4 HANA Finance. Before you enroll in ZaranTech’s certification course on SAP S/4 HANA Finance, do check out the S4 HANA Finance demo:

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999